Boosting Lead Generation and Embracing Client-Focused Strategies with Steve Gresham

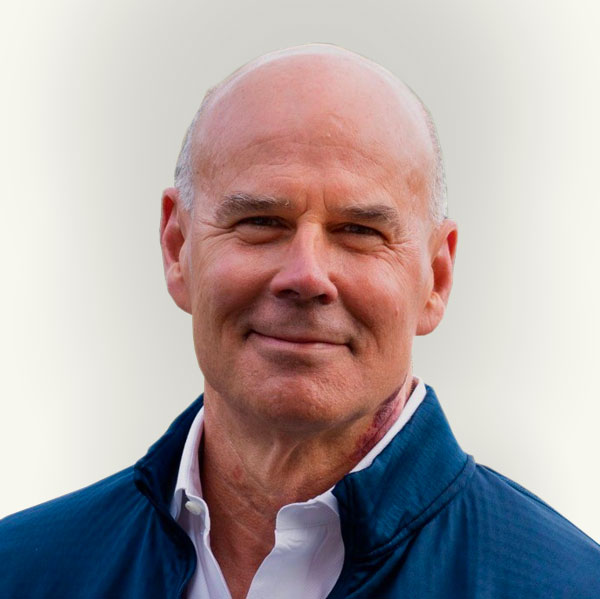

In this episode, Jack talks with returning guest, Steve Gresham. Steve is the CEO of The Executive Project, a consulting firm that provides tools and training for financial advisors.

As an industry leader, Steve has spent time in many different roles. Outside the office, he is an ardent advocate for rethinking, reimagining, and restructuring the concept of retirement. Steve has been a long-time proponent of shaking up the industry and inviting more channel collaboration across teams.

Steve talks with Jack about lead generation, the importance of taking the next step, best practices for better engagement with clients, and the benefits of using the right tools.

What Steve has to say

“Tool sets allow you to not only provide clients with a more consistent experience—which also drives referrals because they’ll say, ‘Well, here’s what you can expect and it’s painless…’—but it also allows them to have the progression in lead generation and next best action.”

Read the full transcript

Jack Sharry: Everyone, thank you for joining us on WealthTech on Deck. I’m especially excited about today’s podcast. Usually we talk with the industry executives about their strategy regarding the future of wealth management and a particular focus on the confluence of digital and human advice. Today, I’m joined by first repeat guest, it’s my good friends, Steve Gresham. Steve has served in many roles, including industry exec and consultant and leader and thought leader, legit thought leader. By the way, that term is too often overused, divas for real. So Steve has done and continues to do all sorts of very cool stuff across our industry. I’ll let him fill you in on what he’s been up to. Actually, since our last podcast, he was actually our first recording way back when when we started 30 or more episodes ago. But Steve has done and is continuing to do such great work, I thought it’d be fun to have him back to talk about some of the things he’s focused on. We have a particular focus today on lead gen and next best action. But Steve, welcome. Good to have you on board. Good to be back chatting about the future of financial advice.

Steve Gresham: Yeah, it’s great to see you too, Jack. And even though we talk all the time, you know, for the benefit of the other folks. So the big things happening in our world is continuing this journey of rethinking, reimagining. And candidly, restructuring retirement, the friction points and the blocks to advisors doing business really have not gotten that much better. And so we’re going to continue on this mission, I suspect for quite a while, I hope we have enough time to catch up to the clients. Because again, you know, the median baby boomers, now 65, 12,000 people retiring every day. Now, the industry has a sense of urgency here really to be able to do something. So my focus is trying to channel that it’s really a cross industry collaboration. That’s the part that’s missing. So if you think about when you and I go back a long way to helping to structure the managed account business, that’s really kind of a parallel today, in the old days of the managed account. Initially, there was a sort of competitive thought from the different firms saying, maybe my managed account program is better than somebody else’s. And what we’re finding now is that a lot of the retirement income industry is kind of thinking the same way. And that’s really not productive. So we well we need to do is do what we did, then with managed accounts, let’s find out the stuff that is in common, let’s find out those kinds of key issues that benefit the clients and make it easier for the advisors to deliver this professional service.

Jack Sharry: I mentioned earlier that you’re doing all sorts of cool stuff, what do you feel the focus in on what you’re working on some of the projects at high level?

Steve Gresham: Sure. So my world is pretty much free. First is to be able to lead this industry initiative. Next Chapter, which is a collaboration with Financial Advisor magazine Money Management Institute. So we’ve got big footprint of advisors, and also the industry leading firms. And we’ve got six study groups that are working on each have specific projects that lead to simplification of some of the issues around retirement. And there’s some more interesting news coming very soon about about next chapter that enrolls into the consulting firm the Executive Project, where we are continuing to be retainer consultants working with some of the leading firms in the industry, to try to execute against those issues that were scaring up in next chapter. And then finally, you know, as a firm, once in a while, we see a capability that we think is really, really important to be able to use in some of these solutions. And we make a direct investment in that arena. So we’ve done a couple of those and, and you know, more to follow.

Jack Sharry: So let’s zero in. But let’s start with the bigger picture, the bigger picture as you talk about retirement, it’s complicated. There’s a lot to it, there’s the accumulation aspect of getting toward retirement, you want to do that? Well. There’s the decumulation or withdrawal that’s complicated, very complicated. It gets in all sorts of products, holdings accounts, such as annuities, and investment accounts and models and all the different stuff that we hear, even go so far as to get into things like healthcare and lending. And there’s all sorts of different issues that I know you deal with. So if you talk a little bit about the big picture, just for context, and we want to zero in on that lead gen next best action, but maybe that big picture as a starting point.

Steve Gresham: Sure. So you know, so we have created an industry that follows the preferences of the clients. And for most of the last 30 years plus, we’ve been helping them to save and to accumulate for retirement retirement is a sort of far off fuzzy objective for most people until it becomes real. And it’s sometimes startling how much of a shift mentally emotionally that that is created in people that head to that age. And so the industry is, in other words, sort of cruising along with one View. And then it seems sometimes even to top advisors, that there’s an abrupt change. And there’s an abrupt change in this client, because candidly, there’s an abrupt change in their life. And so as an industry, though, we haven’t really coalesced around that shifting from the stockbroker, to the managed account professional and the consultant, that took a long time, and there wasn’t any specific urgency to it, there’s significant urgency to being able to catch up to this clientele today. You know, if you have 12,000, people retiring every day, as you’ve mentioned before, you know, you have an awful lot of folks that are just not in the same spot that they were, and the COVID is throwing gas on that fire. So for advisors who look around trying to figure out how to support the client, we have instead sometimes a new view, we have a view, it’s not just a head of household anymore, it’s a household, three generations typically, and trying to balance the needs, the financial needs of all those folks, we have at the same time, optimizing the decisions associated with that, I don’t know how you can make real progress in that situation unless you understand the client’s health. And that happens to be their number one concern, I don’t know how you could do it without understanding taxes and the burden that goes to all the folks from that, you have to be able to pick those benefits that jump right out at you and force you to make a hard decision, Social Security and Medicare 62 64. And then more of an issue we’ve seen recently, as people stop having a regular paycheck, they wonder where they’re going to get access to the cash when they have to make some of these big bills go away, whether it’s tuition, long term care, second home, whatever it might be, because you don’t have a check. And so now, how do you get access to that? So as we look at it, and I know, we’ll dig into lead generation, next best action, they’re all framed inside of this great big shift that’s going on, again, as I said, emotionally more than even financially for people who are rolling into retirement, and the industry is just not wired that way.

Jack Sharry: So, Steve, as we look at the big picture, it’s big, it’s complex, there’s a lot to it. It’s hard to explain. In fact, I’ve shared the story of some others. But I was talking to a neighbor of mine, I spend time in Vermont, as you know, and talking to a neighbor, we were just meeting for the first time. And she asked what I did, and I gave her this lengthy explanation about LifeYield. And all the wonderful things we do. And she looked at me cross eyed and said, So what do you do? And I said, we maximize retirement income. And she goes, oh, where can I get that? So that is the challenge, right? Is how do you break it down into understandable bites. And as you and I have talked about, there’s a few ways that that can be done. It’s let’s focus on lead gen as a start, and then we’ll talk about next best action as the second item. But it starts by engaging the client with a conversation, what say you? How do you do that? What are some ways to go about that?

Steve Gresham: Well, actually, we should just follow the lead that you have sitting there in Vermont, because that’s what lead gen is lead gen is somebody’s thinking kind of like I think, or knowing what’s on my mind, and then getting my attention at a time when I may not actually be looking for that particular thing. So you know, the great thing about being able to work across the miracle the Worldwide Web is that you can drop a message out there that resonates with people. And if you put it in a place where they weren’t necessarily thinking about it, you’ve now created lead gen. So a little banner that says, Hey, I’d like to maximize your retirement income for you. And if you see that no matter where you see that, that actually is something that is going to get somebody’s attention. So basically, what we’re after right now working with our clients, is to understand what those messages are, they’re pretty clear, the clients are very transparent about what those worries are, because they are mostly worries. And so worries and fear are always a better motivator than simple greed, or more or more and more.

Jack Sharry: Sure, so one of those issues that they’re so worried about, what what are some of them once you identify? Yeah, so

Steve Gresham: and I will refer to some work that’s been done by the Alliance for Lifetime Income, where I spent a lot of time and also by our friends at Allianz who did a survey across all age groups. And I want to come back to that, because that’s very interesting development that I think is a byproduct of two issues. One, the influence of the COVID across families. But then also, I think it’s an issue of families understanding that they are now all in this together financially, because I think the COVID has done that as well. Now, you’ve talked about that for years, the concept of the family and householding, but I think they’ve seen it for real. So the big three that come up, have not changed. So the first one is, I need to be able to pay for my health care, and again, across all age groups. So this is not just a discussion about older people and retiring folks and what are they going to do and is Medicare enough? This is all age groups wondering how they’re going to pay for health care because they’ve seen it now the approximate issue. The second one that pop syrup is some form of peace of mind. Now you think back when you and I got in the business, you could get 15% out of a treasury bill, people look at you today, and they think you’re crazy. So it just means we’re old. But so there is no peace of mind, riskless return that you can get, it’s now got to have a replacement. And that’s something that I think is hard for the industry to grasp. Because the industry focuses so often on this kind of abstract concept of total return, which might be mathematically appropriate, but it’s not emotionally appropriate. So it’s not catching the people in the giving them the peace of mind that they want, because they’re not interested in that. And if the market goes down, and you know, knock wood, we haven’t had that problem for a long time, 12 and a half years. So the peace of mind is a manifests itself primarily in retirement paycheck. So even if you provide a total return portfolio, if you don’t have the presence of mind as an adviser to create a check for people, you and I know an awful lot of successful people. One of them that we know in common the other day said that to me, he said, I create this distribution, I get this check once a month, and I feel like I’m working and it works out terrific. So that that peace of mind paycheck guaranteed income, that’s critical. So that pops up. And then the third one that seems to roll around in folks, not again, focusing very often is that how are we going to get access to cash. So when we need access to cash, if you need a replacement roof, if you need some other kind of big ticket, something that happens in your life? Where will I get that because I’m not used to having no paycheck, and so that you have no idea where I get access to the cash. So this is that’s kind of a liquidity move. The other one is a peace of mind, guaranteed income retirement paycheck. And the third is talk to me about my health. The wrapper for all three of these is what happens to the market. So the additional anxiety created by 12 and a half years of a bull market. There is no one that is retiring right now, who is is not old enough to remember the tech wreck in 2000 to 2001, or the financial crisis 2007 08, early 09, so they know something can happen. And that creates anxiety as well. Sure.

Jack Sharry: So you and I’ve talked about this as well, at LifeYield. We have a security optimization tool, which was part of a larger capability early on. And our friends at Franklin Templeton said, can you just give us the social security tool? So we did that? Reluctantly, frankly. And as it turned out very wisely did we fulfill on their request, and we have over 100,000 advisors using that tool? And why? Because it’s what the clients asked them. So talk about that the fact that a lot of this is generated from the client when they use it. And we’ll get into next best action because inevitably leads to further actions. But comment on that if you would just about the fact that investors want to know, when should I file for Social Security as an early on question. Certainly after the turn 50. They’ve kind of are thinking about it. They’re thinking about retirement. And now of course, as the air lives and some significant research, people are retiring every day than ever before. So comment about about that whole idea of paying attention to what your customers are trying to figure out.

Steve Gresham: Yeah, and this, unfortunately, Jack, we can’t have this conversation unless we bring in the dreaded aspect of scale. So the real question is, if you’re a full service, financial advisor, and let’s say you have, you know, kind of industry average 150 households or so, you know, it’s as simple as asking the question of the advisor, do all 150 of my households do they all know and have we had the conversation about Social Security, Medicare, and it really doesn’t matter what their age is, it’s really a question of being able to get completely through that book with the services that you provide. Because as you know, as we’ve talked over the years, I remember rolling out Merrill Lynch, private wealth and the non US market, you know, over 20 years ago, and one of the first things all of these top advisors from all over the world said is that we do all these things. I don’t know why we have to talk about this. Well, what you found, though, when you looked a little bit closer, was that after the first few households, you know, and I’m not talking at 20, I’m talking an awful lot fewer people. So it might only be 10% of the households, 15%, sometimes 20% that really get the full suite of what you do. That’s one of the reasons why tools are so important. Because tools can be sent to clients tools can create engagement, self actualization by the client, I didn’t really get that entirely until I became responsible for the fidelity, basically the fidelity retail client strategy, because we were impossibly outnumbered by people who were streaming in mean, the business grew from when we started less than a trillion. And now it’s over 4 trillion. It’s 10s of millions of people. And it’s just impossible to send humans after all the humans. So you’ve got to be able to put tools in the hands of people that are very simple, very intuitive, that allow them to answer a burning question. And the thing about Social Security is that it’s a pressure point, it’s something you have to do something about. And the next one up on the list is Medicare. and I both know people that have agonized over those decisions, and they’re financially savvy. So the idea of having a very simple tool is allowing is facilitating this match to a client concern, but with the perspective that it can be done at scale, so that when the client is ready and gets around to it, they can then engage on their own time to get to the advisor to say now what’s next or just to validate what they found.

Jack Sharry: So an example of that is we work with lots of advisors, lots of firms name brand firms on this topic, one of which is Merrill, which uses our security tools white labeled, it’s called the Merrill security analyzer, what they tell us is that 98% of advisors use the tool and that the reason they use the tool is that it’s a simple way to have a conversation or answer a question, and really, the clients are asking, and what inevitably turns into is, after they’re shown that they can have on average, our average is about $140,000. of increased income over time, by using the tool. They then say, I want that what do I do? And then there’s a filing strategy that suggested, more importantly, inevitably leads to a product sale, which is really the lifeblood of what an advisor does, certainly historically, but it starts to move it into endless this will take us into our conversation around next best action, it leads them in that’s a lead gen or it’s a conversation starter is something that you resolved in the the reports from the many 1000s of investors that are the advisors we work with deal with, what they find is that because they they got a benefit, just by working with that advisor, it leads to not only the product sale, but for the product sales, because inevitably, the next question, next best action they need to consider is what do I do about my rollover? Or what do I do about Medicare? Or what do I do about whatever it secures the relationship between the investor and the advisor? Because they’ve gotten good value? They got more money? Basically, by answering a simple question, what do I do about Social Security? So talk a little bit about that led into the whole next best action, because this is all in the context of comprehensive household management. It’s a big thing. But it starts with a step by step. I mean, coming up on that, and what you’re seeing and kind of work you’re doing is part of your practice.

Steve Gresham: Yeah. So I think you know, you set the stage perfectly. The challenge here is for clients to understand that there is somebody out there waiting to help them. Now think back about where we are. So if you look at the where most of these clients are, at the end of 12, and a half years of a bull market, there is a tendency along the way, since most of them, we’re still in that accumulation phase to try other products, other stuff other people. So they typically have four or five, six different products or company relationships. And so that that begins in kind of a fractured race to see who’s going to pay attention. We know that people leave their custodians, most often because of one or two of these key issues. One being relationship, what they say is relationship. The other is called Planning. These are subjective determinations, though relationship really means proactivity. Did somebody know that I was out here. And so again, it doesn’t take some kind of elaborate AI structure to figure out when somebody is 61 and a half and might be coming down to the wire on their first marker for Social Security, or if they’re 63, 63 and a half, and all their friends that are 64 are agonizing over Medicare. So you know, relationship and proactivity are pretty easy. You get to the planning part, though, it’s a little more foggy, because planning, again, is a subjective judgment. Planning could be something it’s very simple. Personal Health Care has already transcended this issue, by the way, because personal health care now gives you chances to get in and out quickly on something, they’ve actually helped perfect that system during the COVID. So that they’ve been able to get you vaccinations in and out, they’ve reached a level of efficiency that nobody’s ever seen before. So he put that back on the financial industry, are you thinking about me, and something as simple as we’re just checking in, even if somebody else has already gotten to you, if you are the client, even if one of these other providers has already gotten to you, it is refreshing to know that somebody is really paying attention. That is the biggest missed opportunity for the companies. And you can see this in real time. And we saw it at Fidelity, where we were responsible as the largest retirement company in the world, we were responsible for keeping track of those MRDs. Now those Mr. Deeds ended up being an opportunity without parallel for conversations with clients, because they had to talk about something, you know, this money is coming to you, and what do you want to do with it? So that kind of thing. That’s what we’re after. Because one of the challenges that we have and the work that we do is trying to explain to companies do not spend so much time looking for the shiny new FinTech toy Look right back at where you are, and understand the potential for a more complete adaption of the stuff that you’ve already got. There is significantly greater benefit in getting all of that done before you go moving on with something that, frankly, is just going to be harder to make the rest of your business continue along.

Jack Sharry: Yeah, one of our clients is working on just what we’re talking about, Steve, they’re advanced in terms of what they’ve been building in the context of UMH structure and all that they’ve done a very good job, but they’ve come to realize it’s all about the initial engagement, how do you get people in the game because the orientation as we well know, we grew up in it, our business is oriented toward products, counts, sales, that’s kind of in the DNA of the advisor, as we’ve grown up in this business and work with so many they’re trying to shift it to how do we engage on what they call micro engagement? How do we engage with folks on? What about a Roth conversion? What about security? What about? What about required minimum distributions? What do I do about that? At what point do I take action. And the idea and this gets back to our next best action is to engage on the front end, that lead gen have a sword. Many of these are with existing clients, of course, but then once I get them started on one thing, my experience I think you have the same love to hear about it is what do we do about it now that we’ve done this one thing, what’s the next thing and the next thing that kind of leads to the planning discussion you’re describing? We think of planning as some big thing we do? Well, that was 20 years ago, the big book, the big lot of data, a lot of information, a lot of pain and sorrow, and then no one did anything about it. What you and I are talking about really is how do we get people in the game to do the next best thing, and then have them do it repeatedly, time after time to get to where they’re really trying to achieve, which is an approved retirement outcome?

Steve Gresham: Well, here again, you know, this is the scale working right. And so again, one of the biggest challenges we have even with top advisors, even with great firms, is to understand that there is a significant significant opportunity for segmentation. The very top advisors don’t need the same kinds of support that let’s say the average advisor needs, the highest net worth families that are the most sophisticated, don’t need the level of support in many ways for some of these information or educational components that maybe ordinary people do, average people do. And that’s where the vast majority of the opportunity remains. So I can’t help it, but kind of get a feeling that the industry continues to skew towards bigger and bigger and more valuable clients, and forgetting in mass, the opportunities among the giant number of people who are rolling toward retirement. And that’s kind of a you know, in many ways, that’s an optimization of a top advisors saying I want to work with the best, I get that, you know, I’ve worked with top advisors, as have you most of my life, but the opportunities are really being created down below. And I’m gonna go back to the household for a moment. Because if you look at where we are today with these clients, the danger of narrowing in on a increasingly small number of clients, because they’re incredibly profitable, and you know them so well means that you’re actually accelerating the pace that you leave behind this enormously growing rapidly growing group of people. So the risks are if you can’t find a topic that those people can connect with you on, which is why I think Social Security, Medicare, some of these things are just total no brainers. Because if you got to the people, then you’d be able to engage in what you’re saying is, and go back to the value of lead gen. If I talk to you about something that is on your mind, then I have an advantage over everybody else. But I have to tell you that it’s on my mind in order for you to know that. And I know this sounds ridiculous, but even keeping track of these inflection points, when do heads of household start thinking more seriously about planning? Well surprise, the age of 50? Okay, well, how hard is it to find the 49 and a half year olds, it is if you’re working already with the household where you’ve got the parents, and they’re 75. So very interesting firm I’ve been working with most recently has a Trust Company, and the Ria and the community bank. So they’ve actually got all three of the big issues that we’ve talked about, got those pretty well covered, because they’re able to provide the right kind of products, they’ve got the setting for lending with the community bank, and they’ve got the Trust Company, which usually ends up being the one that is kind of like the conscience that reminds everybody of what you need to do, you know, for even some very simple things like powers of attorney and the right kind of trust. So this whole concept of reaching down is actually very lucrative because this is where that succession, intergenerational wealth transfer play begins to hit and the Allianz survey is very important to understand that you know, wellness and guaranteed income and all those kinds of things are actually of concern to people of other age groups. So I’m looking right now at companies. And I am mystified why they do not see the risk associated with not engaging as they roll downhill through these families. Because if you get the older folks wrong, you lose their money, you lose the non consolidated assets, because even if you’re 80, you’ve got some stuff, probably stuck someplace else, you’ll never see the next generation or The Heirs. So now you’re over three. And if you work in your local market, you should be very, very conscious that any one of these problems could lead to some kind of regulatory issue. Because if you think the states aren’t coming through consumer protection to make sure people are are keeping track of their older clients get ready for this one, we saw it at Fidelity, I wouldn’t be as concerned about the federal government. They’d been on this for a long time. But it is the states that will be most conscious of this issue. And then you’ve got the worst one of all, which again, if you work in your local market, trouble in any of these areas gets around. And so now you’re looking at a reputational issue. That’s the one that’s the toughest to recover from, because now you get branded as that company that didn’t care.

Jack Sharry: Yep, that’s a whole nother podcast topic we should engage with down the road, but for another time, as we try to keep our podcast to a half an hour. So Steve, why don’t you share with our audience three key takeaways of what we’ve discovered that might be beneficial for them in their business?

Steve Gresham: Sure. So again, I think that adoption is the new innovation, that is by far the most important issue, everything that we’re talking about whether it’s financial wellness, whether it’s guaranteed income paycheck, whether it’s the market going down, whether it’s liquidity, you’ve got to have those plays, if we’re allowed to say that anymore, you’ve got to get those services all the way through. That’s the part that is the greatest opportunity for the industry to simply be more pervasive and adopt more fully that which we already have, that has been the key to top advisors success forever. And they actually are the ones that could benefit the most from that. So I would say, adoptions, the new innovation, that’s my mantra, I’m going to stick with it. The second one is make sure that you know what you’re talking about, that it’s important to clients, there’s no reason to talk about anything other than the stuff that’s important to clients, because they are not hearing people talk enough about what to do about health care and incorporating financial wellness into their life, they don’t really know what it means sounds good. But we have to connect with them about what that means that subjective, guaranteed paychecks got to be in place, because the guaranteed income deals with some of the basic expenses that they have. And then again, liquidity is a critical component. And I would challenge most advisors about whether or not they have had solid conversations about all three of those topics beyond the top handful of their clients, because the research says otherwise. And then finally, you’ve got to avail yourself of a set of tools that will allow you to do what I just said, adoption, keep track of these three key issues, you’ve got to be able to do that with tools because tools provide, especially in a future state, which is going to be more regulated than it is today. And not without good reason, by the way, given some of the bad actors in our industry. But tool sets allow you to not only provide clients with a more consistent experience, which also drives referrals. Because they’ll say, Well, here’s what you can expect, and it’s painless. But it also allows them to have the progression that you mentioned, lead generation, next best action, those have to be facilitated with tools that are driving off of your database. Because you’ll never be able to do that with post it notes and Excel spreadsheets. So avail yourself of these common sense tools. And as you said, Jack, the key to those things are simple. We live in an era where if you buy a product and it comes with an owner’s manual, you say, oh my god, I’m not going to use this. So this stuff has to be intuitive. And that means it has to be able to go directly to the clients, for them to be able to come in and say, here’s what I want. Can you help me?

Jack Sharry: That’s great. So as we close for now, and as we do each week, I want to do have you give us an update because you’ve talked about this and our earlier episode that we published. I know you have a fascinating hobby around woodworking and follow it online, you should share by the way, with our listeners where they can find you online with regard to that. So give us an update. How’s Walden woodworking, how’s that going?

Steve Gresham: Now, so Waldenhillwoodworks.com is taking on a COVID surge. So the great thing about it is that since we’re on 15 Zoom calls a day, if one of them gets cancelled, I’ve got a 50 foot commute over to the shop and you could grab something that’s being glued up or poured or something and and so we’ve discovered a couple of designs since we work only with wood that we salvage ourselves. So that’s cutting down the trees and processing them and all that, you know if you can keep at some of this stuff, you can keep a lot of projects going it is the perfect antidote to the sometimes abstract world of lead generation next best action all this other stuff that if you want to do something Think that’s real now you got something and you can give it to somebody or more recently sell it to people and and it’s cool.

Jack Sharry: Yeah, I would recommend you check out Steve online he really does a nice job. It’s fun to watch another note by the way, Steve is a very hands on creative fellow. He’s also quite he’s a master gardener and his home and his gardens are just fabulous. So good with his head good with his hands. He’s, he’s an everyman. So Steve, it’s been a lot of fun to talk on the podcast again. We’ll we’ll do this again. I know down the road. I look forward to the next time. Thanks so much for joining us on wealth tech on deck for those who are listening in if you enjoyed our podcast, please rate review and endorse subscribe, or share what we’re doing here. WealthTech on deck we are up to over 3000 downloads and 2000 listeners. So apparently something’s working here and a lot of has to do with the guests like Steve Gresham. So Steve, great to talk as always, we’ll look forward to the next time.

Steve Gresham: Hey anytime, Jack. Great to see you again.